The History Of Fintech

Did you know that the history of Fintech (that’s millennial speak for ‘Financial Technology’) spans over a hundred years?

Today, we take it for granted that our banking can be done online. From making payments via mobile apps to buying shares on your PC, pretty much anything finance related can be done from an internet enabled device. But how did we get here? And have you ever considered the incredible technology that sits behind the interface you interact with on screen?

Ensure your sound is on or your headphones are plugged in.

“FinTech is not only an enabler but the driving engine,”

Pierre Gramegna, Minister of Finance for Luxembourg.

Financial technology has powered almost every advancement in the banking world and this industry is now regarded as one of the most innovative and exciting sectors to work in. Over 40% of workers in London are employed in Finance or Technology roles!

History Of Fintech Timeline:

1918 – US Federal Reserve Bank launches its ‘Fedwire’ service to enable funds to be moved electronically

1928 – The Charga-Plate is used in the U.S. to record payments via an embossing method

1958 – Bank of America launches the first BankAmericard, which is regarded as the first ever credit card

1966 – UK’s first credit card (Barclaycard) is issued by Barclays on June 29th

1967 – First ever ATM is launched at a Barclays bank in Enfield, London

1971 – Nasdaq launches electronic trading and it becomes possible for companies to sell shares to the public via an Initial Public Offering (IPO)

1990 – Shoppers can now request cashback on debit card transactions

1995 – Amazon launches its online shopping site, initially only selling books

1997 – The first UK internet banking service is introduced by the Nationwide Building Society

1998 – Paypal is launched (originally called Confinity)

2011 – Google introduces Google wallet

When you consider the sheer volume of innovation that has been introduced within the finance industry over the past hundred years, it’s no coincidence that this sector is now home to some of the most interesting and exciting startups in the digital market.

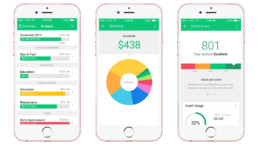

FinTech companies both small and large are disrupting the market by injecting life into what was once regarded as a dull and stuffy industry. Even the way they connect with customers is exciting – using cool video animations, engaging videos and interactive interfaces to display finance related information that previously would have been detailed in boring black and white documents.

(Example of the interactive interface used by Mint.com)

So, what’s next in the world of Fintech?

Opportunity! New tech, new ways to pay, a lot of automation and even job creation for roles that don’t exist yet, the world of FinTech is sure to continue advancing at lightning speed.

We’ll continue to see the emergence of small, agile Fintech startup companies who will leverage new technology to provide affordable finance solutions to businesses and innovative payment options for consumers. This disruption to the market will no doubt be the catalyst for large, established organisations to change their approach to be far more technology led, with a greater focus on openness, connection and inclusion of customers.

Why Should I Care?

If you’re a business owner and you sell any sort of product or service to other businesses or members of the public, you’ll likely have been influenced by the world of Fintech.

In the UK especially Fintech has hit the banking world hard, with ‘online only’ banks such as Tide, Monzo, Revolut and Starling revolutionising the way in which businesses carry out their traditional banking services. If you’re still sending out paper invoices, it might be time to check out some of the really simple but fantastic Fintech accounting companies out there such as Xero and Quickbooks.

Whatever your level of interest or knowledge about the history of Fintech, one thing is for certain. The internet is becoming an increasingly valuable asset to every business owner who truly understands its capabilities and opportunities. Netflix, Google, Facebook, Uber and Xero all have one thing in common – they are absolutely driven by technology.

What Do We Know!?

As an animation agency we work with a wide range of clients to produce engaging animated videos. Fintech animation is an area we really enjoy working in and have been fortunate to work with some fascinating and exciting businesses within the industry.

Featured below is a conceptual animation for one of our Fintech clients Autorek.

Find out more about us and the work we do or contact the team for any additional information on our animation services.

Share this bite

The Animation Video Workbook

The 1-stop shop for everything you need to know about making the most awesome video possible